Innovative Educator

In her Economics and Personal Finance class at Heritage High School in Newport News, Virginia, educator Tiffanie Smith strives to illustrate the importance of personal finance skills to her students in every single class session by using real-world examples, including stories about herself.

Tiffanie has worked in education for 25 years, but it was only 10 years ago that her district started offering a personal finance course. Tiffanie was a perfect fit to teach it because of her undergraduate degree in accounting and her passion for financial health. “For students to be able to manage their own money is critical, and it’s really a survival skill,” Tiffanie explains. Since then, she has taught approximately 10,000 students. In 2010, the course became a requirement to graduate from high school in the state of Virginia.

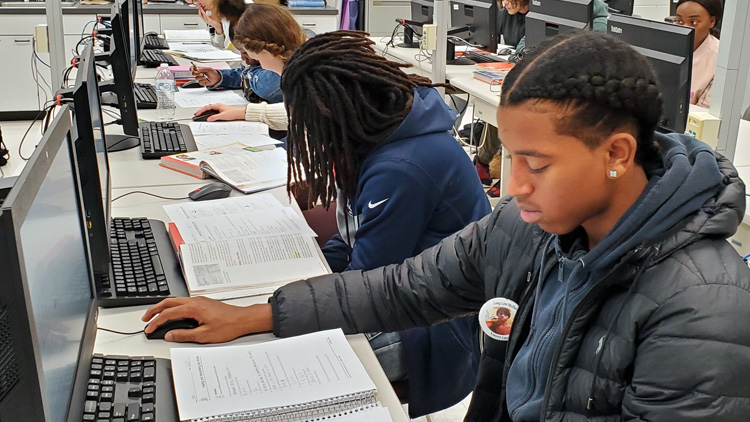

Tiffanie’s students use textbooks, worksheets and computers to learn about personal finance.

The majority of Tiffanie’s high school students come into her class with limited knowledge about personal finance. Even those students who do have background knowledge often don’t have basic finance skills, like understanding a pay stub. To teach these important skills, she uses a combination of online resources, textbooks and reality-based projects.

One such project is “Cost of College,” during which students spend three weeks calculating how much college will really cost them. The goal of the exercise, says Tiffanie, is to encourage students to take advantage of scholarship opportunities. Another reality-based project that Tiffanie uses involves assigning students a hypothetical career, salary and family. Students are then tasked with designing a budget that outlines how they would purchase necessities. These types of projects help students realize how much certain aspects of life cost and how critical budgeting is to financial wellness.

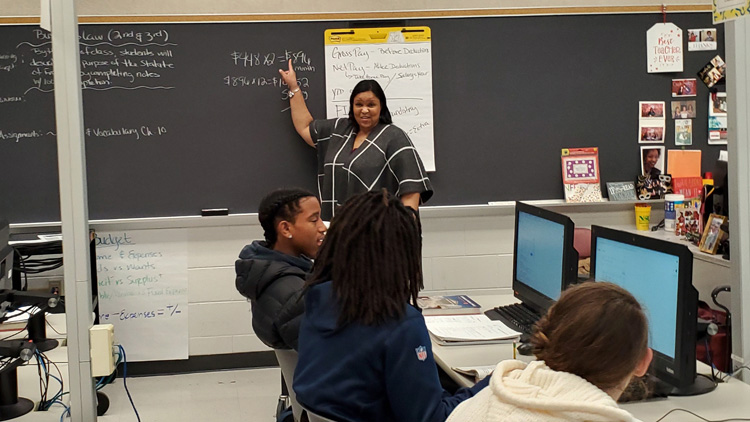

Tiffanie teaches at the blackboard as her students look on.

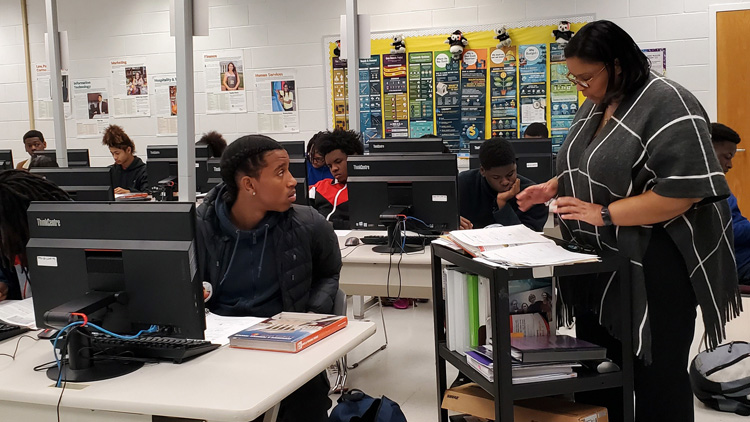

Tiffanie uses online resources to evaluate and engage students. “There are so many resources out there. Some are good; some are wonderful,” she says. Particularly useful are resources that students can share with parents, like the Money 101 Student Workbook from Practical Money Skills. “Practical Money Skills seems to hit directly on everything that needs to be discussed,” she says.

Students also hear from guest speakers to solidify the real-world importance of what they learn in the classroom. Representatives have come from local banks, credit unions, universities and various industries to reiterate topics that have been covered in the course. Tiffanie partners with a credit union to host a Financial Literacy Night for parents and students to discuss personal finance topics one-on-one with representatives from the credit union.

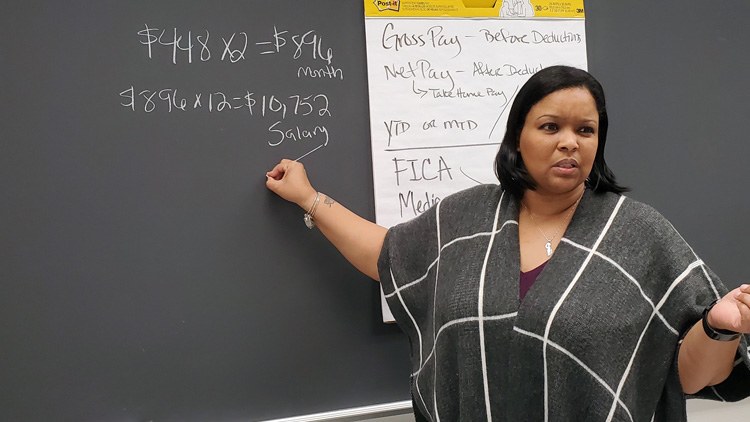

Tiffanie teaches paycheck math at the blackboard.

Tiffanie is also able to teach personal finance skills to students who are not enrolled in her class through her school’s student-run credit union. An initiative that Tiffanie pioneered, the credit union has allowed students and faculty to make deposits and withdrawals at a kiosk for the past six years. Last year alone, 85 new accounts were opened. The credit union is staffed by its own members and hosts monthly activities to promote financial literacy, such as trivia competitions. This organization has been named the most outstanding high school credit union in a local competition for the past five years.

The most important successes for Tiffanie, however, are those of her former students who are financially stable at a young age. “I have former students who have gone off to college, graduated and become planted in a career; several of them have purchased their first homes,” she says.

Tiffanie speaks to a student and references personal finance education resources.

For Tiffanie, each of these successes is a source of personal pride. She explains, “I look back on my own generation when we first graduated from college, and I didn’t have the foundation that my students are getting in high school. Personal finance courses weren’t offered, and we had to find our own way. I want to teach these kids to save money for a goal, and then I will have done my job.”

Practical Money Skills would like to commend Tiffanie Smith on her ongoing efforts and commitment to financial literacy at Heritage High School.

Share